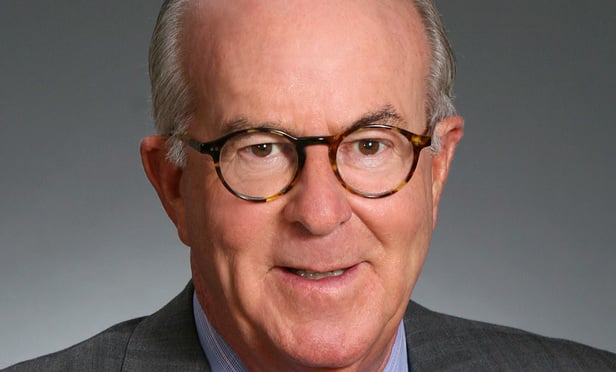

The U.S. Securities and Exchange Commission on Thursday accused a senior Nelson Mullins Riley & Scarborough partner, Robert Crowe, of playing a key role in an illegal “pay-to-play” scheme aimed at helping State Street Bank and Trust Co. secure public pension contracts in Ohio.

While State Street agreed to pay $12 million to settle the agency’s claims, the SEC on Thursday filed a civil complaint in Ohio federal court against Crowe, a Boston and Washington, D.C.-based co-chair of Nelson Mullins’ government affairs practice.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]