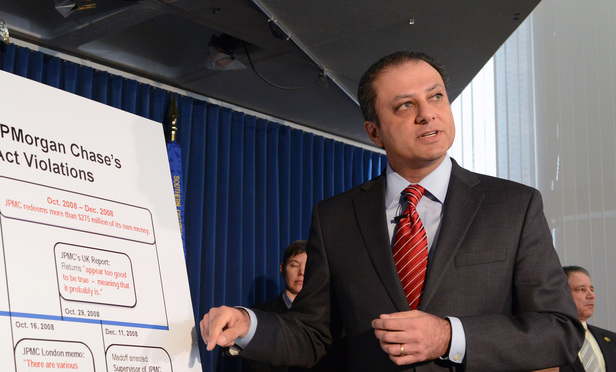

Manhattan U.S. Attorney Preet Bharara has had his share of big weeks since taking office nearly five years ago. But even for him, the last one was a doozy. Bharara netted his 79th (!) straight insider trading conviction on Thursday, securing a guilty verdict against former SAC Capital Advisors portfolio manager Matthew Martoma. And his office started the week with a record-breaking False Claims Act settlement against a bank, inking a $614 million deal to resolve allegations that JPMorgan Chase & Co. duped two government agencies about loans that it underwrote or originated.

Bharara, the top prosecutor in the Southern District of New York since mid-2009, has spearheaded nine major cases against Wall Street banks since 2011. During his tenure, the 50-lawyer Civil Division has become a noticeably activist, risk-taking department, using some of the most powerful civil laws at the U.S. Department of Justice’s disposal and applying them in new ways and against new financial targets. In the process, Bharara’s office has prompted several important precedents vastly expanding the scope of both the False Claims Act and a savings and loan crisis–era statute, the Financial Institutions Reform, Recovery and Enforcement Act of 1989.