RF Micro Devices is acquiring TriQuint Semiconductor, a rival producer of radio frequency semiconductor chips, in an all-stock deal valued at roughly $1.6 billion.

Billed by the companies as “a merger of equals,” the transaction calls for owners of shares in Hillsboro, Ore.–based TriQuint to receive 1.675 shares of the combined company for each of their TriQuint share. RFMD shareholders will receive one share of the newly formed company in exchange for each share of Greensboro, N.C.–based RFMD. The deal creates an implied value of $9.73 for each TriQuint share—a 5.4 percent premium over the target’s Friday closing price. The companies’ respective shareholders will own roughly 50 percent of the new entity.

The transaction would create a combined company with more than $2 billion in annual revenue. It would also generate at least $150 million in savings in the first two years following the deal’s closing, which is expected to come in the second half of the year, pending the approval of regulators and both companies’ shareholders.

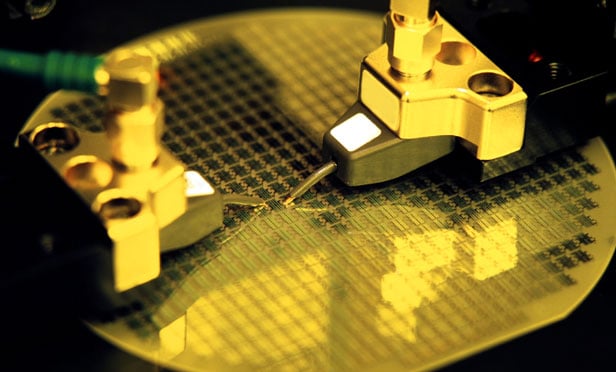

The two companies hope to combine their complementary offerings in a way that creates a leading supplier of radio frequency chips and products for the mobile device industry. Both companies make semiconductors used by such clients as Apple and Samsung Electronics to help their mobile devices connect to voice and data networks.

RFMD is being advised by attorneys at both Weil, Gotshal & Manges and Womble Carlyle Sandridge & Rice. The Weil team includes Silicon Valley–based M&A partners Keith Flaum and Jane Ross, as well as antitrust partner John Scribner, tax partner Helyn Goldstein, IP and technology transactions partner John Brockland and antitrust counsel Vadim Brusser. The Weil associates on the deal are Tara Lancaster and Alex Purtill. (Flaum and Ross also led the way last week for Facebook on the social media giant’s $19 billion purchase of WhatsApp.)

Womble Carlyle, meanwhile, is fielding a team led by Winston-Salem–based corporate partner Jeffrey Howland. Corporate partner Louis Barbieri III, tax partner Jeffrey Lawyer, benefits partner James Daniel and executive compensation partner Jane Jeffries Jones are also advising, as are associates Vivian Coates and Matthew Triplett. Womble Carlyle and Magic Circle firm Allen & Overy are currently representing RFMD in connection with an ongoing trade secrets suit the company brought in 2012 against three former employees who formed their own company in China called Vanchip Technologies.

Davis Polk & Wardwell is representing Bank of America Merrill Lynch in its role as financial adviser to RFMD with a team that includes corporate partner Alan Denenberg and associate Tyler Pender.